How AI is Reshaping the 2025 Financial World

Introduction: The Future of Finance is Here

Financial World in 2025: Artificial Intelligence (AI) has swiftly transitioned from a futuristic concept to a powerful force driving transformations across industries. The financial sector is no exception.

By 2025, AI is not only changing how financial institutions operate; it is fundamentally reshaping the landscape of banking, trading, insurance, and financial security. From real-time fraud detection to personalized financial services, AI is making financial processes faster, smarter, and more secure than ever before.

AI’s impact on finance extends beyond efficiency gains. It is about creating more personalized, data-driven experiences for consumers, offering innovative solutions to age-old challenges like fraud prevention, risk management, and financial inclusion. As AI technologies continue to evolve, they promise a new era of accessibility, transparency, and customer-centric financial services.

In this article, we will explore how AI is reshaping the financial world by 2025—from revolutionizing trading and risk management to empowering smarter, safer banking. Whether you’re a finance professional, investor, or just curious about the future of finance, understanding AI’s role is key to staying ahead in this rapidly evolving landscape.

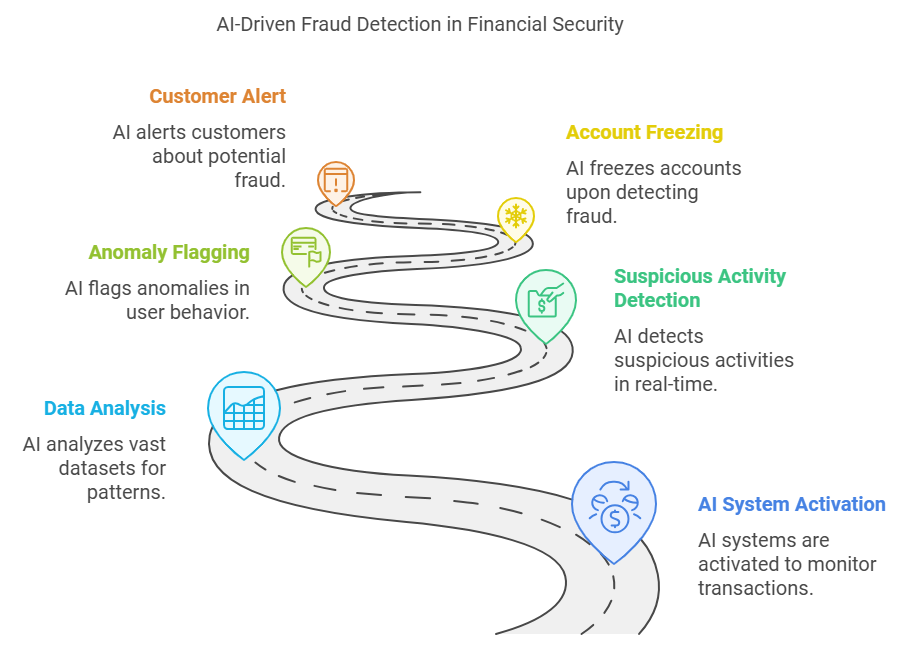

AI in Financial Security: Battling Fraud in Real-Time

As digital financial services become more widespread, security concerns grow. Cybercrime, especially fraud, has escalated, and traditional fraud detection methods can no longer keep up with the speed of technological change. Here, AI is proving indispensable, offering intelligent solutions to this longstanding issue.

AI-powered fraud detection systems are revolutionizing financial security. Machine learning and advanced algorithms analyze vast datasets—transactions, user behavior, historical patterns—to detect suspicious activity in real-time. For example, credit card companies use AI to track spending habits and flag abnormal transactions. If an unusual purchase is detected—say, a large foreign transaction—AI systems can freeze the account instantly and alert the customer, preventing fraud before it escalates.

Additionally, AI is essential in identity theft prevention. By analyzing behavioral patterns across multiple platforms, AI detects compromised accounts early. It can flag irregularities such as login attempts from unusual locations or at odd times, preventing further damage.

The real-time capabilities of AI are crucial in an era where cybercriminals operate increasingly sophisticated schemes. What sets AI apart is its adaptability—AI systems continue to learn and evolve, staying one step ahead of fraudsters.

Revolutionizing Trading: AI and Algorithmic Trading

The trading world is fast-paced and volatile, requiring precision and quick decision-making. Traditional stock trading methods, while effective, often struggle to keep up with today’s global financial markets. This is where AI, particularly through algorithmic trading, is making a significant impact.

Algorithmic trading uses AI to process vast amounts of market data and execute trades at lightning speeds. This enables traders to capitalize on market opportunities in real time, without the delays or biases that come with human decision-making. Key advantages of AI in trading include:

• Speed: AI algorithms can process massive datasets and execute trades in milliseconds, a critical advantage in high-frequency trading (HFT).

• Accuracy: AI identifies patterns invisible to human traders, improving the precision of decisions.

• Emotion-Free Decisions: AI eliminates the emotional bias inherent in human trading, leading to more rational decisions during market volatility.

• Predictive Analytics: Machine learning models predict stock price movements based on historical data, news sentiment, and social media trends, helping traders anticipate shifts before they happen.

Hedge funds and investment banks increasingly rely on AI to optimize trading strategies. AI platforms use deep learning to predict market trends, automating trades that would traditionally require teams of analysts.

The rise of robo-advisors like Betterment and Wealthfront, which use AI to provide low-cost, personalized portfolio management, is making financial expertise accessible to the masses. By 2025, AI will continue to improve trading accuracy and expand its role in investment strategies.

Personalized Banking: AI and Customer-Centric Solutions

In a digital-first world, customers demand personalized, efficient services. AI is meeting these demands by transforming traditional banking models into more customer-centric, tailored experiences.

AI enables hyper-personalized financial services by analyzing data such as transaction history and spending behavior. This allows AI to offer individualized financial advice, optimize spending, and predict future financial needs. Virtual assistants like Erica from Bank of America already provide 24/7 personalized assistance, guiding customers with everything from balance checks to loan recommendations based on their unique financial situation.

Smarter Credit Scoring: AI is also reshaping credit scoring by considering a broader set of data. Beyond credit card usage and payment history, AI incorporates factors like utility bills, rental history, and social media activity, allowing a more accurate assessment of creditworthiness. This has opened doors for underserved populations who have lacked access to traditional credit scoring systems.

AI’s role in fraud detection also extends to customer accounts, flagging suspicious behavior and preventing identity theft before it happens.

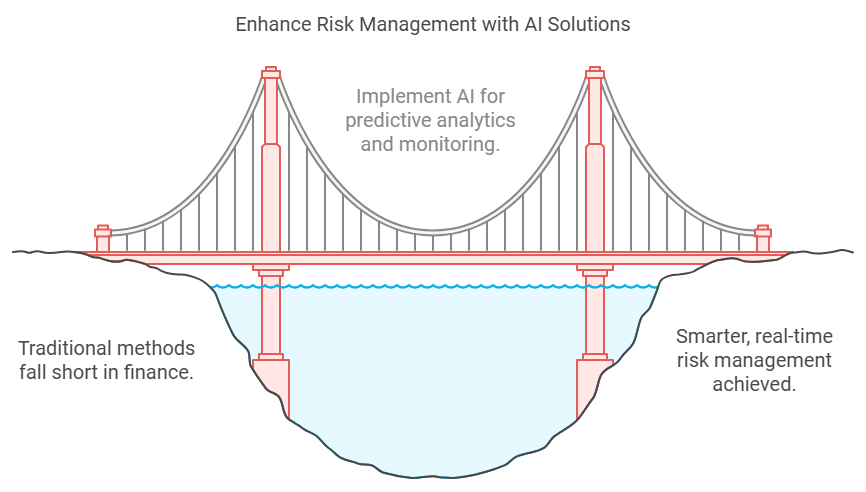

Risk Management: Smarter, More Accurate Decision-Making

Risk management is a cornerstone of finance, but traditional methods often fall short when it comes to rapidly changing market conditions. AI offers smarter, data-driven ways to identify, assess, and mitigate risks in real time.

Predictive Analytics for Risk Assessment: Traditional models often rely on historical data, which may not account for sudden shifts in market conditions. AI, however, can analyze vast datasets—both structured and unstructured data (e.g., news articles, social media sentiment)—to identify hidden risks. This predictive capability enables financial institutions to take preemptive action and minimize losses.

Real-Time Risk Monitoring: AI enables continuous risk assessment, detecting shifts in market conditions and alerting risk managers to potential threats. For example, if a sector shows signs of instability, AI can prompt a reevaluation of strategies or hedging positions.

Stress Testing and Scenario Analysis: AI excels in stress testing, simulating a range of “what-if” scenarios that account for economic, geopolitical, and social factors. This helps institutions optimize risk exposure and prepare for potential market shocks.

AI also plays a critical role in regulatory compliance, automating processes like anti-money laundering (AML) checks and ensuring institutions stay in line with evolving regulations.

The Future of InsurTech: AI in the Insurance Industry

AI is disrupting the insurance industry, improving efficiency and customer experience. From claims processing to dynamic pricing, AI is transforming the way insurers operate.

AI-Driven Claims Processing: Traditional claims processing can be slow and prone to human error. AI automates the process by using computer vision and machine learning to assess damage from images or videos. For example, AI can instantly analyze a car insurance claim, assess repair costs, and even approve the claim in real-time. This speeds up the process, reduces human error, and curtails fraud.

Dynamic Pricing and Personalized Policies: Traditional insurance models use broad categories like age and location for pricing. AI, however, can adjust premiums in real time based on granular data, such as driving habits, exercise patterns, or wearable device data. This enables insurers to offer usage-based insurance models and highly personalized coverage options.

Predictive Risk Assessment: AI’s ability to predict future risks—such as natural disasters or emerging cybersecurity threats—helps insurers better manage reserves and adjust pricing to reflect potential future losses.

Enhancing Customer Service: AI chatbots and virtual assistants provide 24/7 support, guiding customers through the claims process and offering personalized recommendations. These tools increase customer satisfaction and reduce resolution times.

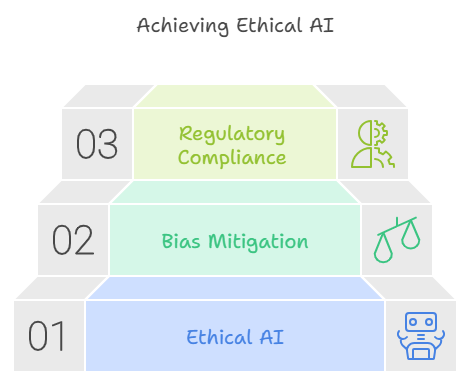

Overcoming the Challenges: Ethics, Bias, and Regulation

While AI presents immense potential, its rapid adoption raises significant concerns. Ethical considerations, biases in AI systems, and regulatory compliance are all challenges that need to be addressed.

Ethical AI: One major concern is the transparency of AI decisions. Deep learning models are often described as “black boxes,” making it difficult to understand how decisions are made. Financial institutions are working on developing explainable AI, which will provide clear explanations for AI’s decision-making process.

Bias in AI Systems: AI systems learn from historical data, which can contain biases related to race, gender, or socioeconomic status. This can result in discriminatory outcomes, such as certain groups being unfairly denied credit or charged higher premiums. Ensuring diversity in training data and implementing bias mitigation strategies will be crucial in making AI systems more equitable.

Regulatory Compliance: Governments and regulatory bodies are working to establish guidelines that ensure AI is used ethically and responsibly. The GDPR in Europe and the Fair Lending Act in the U.S. are examples of efforts to regulate AI in finance, ensuring it is both transparent and non-discriminatory.

The Road Ahead: What to Expect from AI in Finance by 2025

By 2025, AI will continue to revolutionize the financial industry, driving innovation in personalized financial products, AI-powered advisory services, and financial inclusion. Expect to see:

• Hyper-Personalized Financial Products powered by AI that dynamically adjust to a customer’s needs.

• AI-Powered Financial Advisors offering sophisticated, 24/7 advice.

• AI and Blockchain Integration to make transactions faster, safer, and more transparent in the growing realm of decentralized finance.

• Financial Inclusion boosted by AI-driven credit scoring and microloan systems.

Conclusion: Embracing the Future of AI in Finance

AI is leading a transformative wave in the financial world, improving efficiency, security, and customer experiences. However, as AI becomes more embedded in financial services, addressing its ethical, regulatory, and bias-related challenges will be crucial.

By 2025, AI’s potential to democratize finance and promote inclusion could reshape how we interact with financial products and services, making them more accessible and equitable for all.

One Comment